Due to escalating geopolitical tensions, the impact of crude oil prices on national economies has once again become a topic of discussion. Brent crude oil prices, which had fallen to USD 60 per barrel at the beginning of May, rose rapidly due to recent developments, approaching USD 80 per barrel. Although international prices have retreated again amid easing tensions, they appear to have stabilized at a higher level than before (Graph 1). The significant increase in prices coupled with the possibility of disruptions in supply channels make it necessary to revisit the possible effects of crude oil prices. In this blog post, we quantify the effects of potential increases in crude oil prices on inflation and the current account balance in the Turkish economy.

By nature, crude oil prices may display high volatility due to both supply and demand developments. A look into the recent past reveals that crude oil prices have often deviated significantly from their annual averages. For instance, the Brent crude oil price, which was around USD 70 at the beginning of 2022, rose rapidly due to geopolitical developments, and soared to USD 128 in March 2022. In the following period, prices fell back to around USD 80, resulting in an annual average of USD 99 (Chart 2).

As Türkiye is a net importer of crude oil, developments in international crude oil prices have significant macroeconomic implications for the country, particularly for the current account balance and inflation. Higher crude oil prices have a direct impact on consumer inflation through increased fuel prices.[1] Since fuel is a main input, transport costs and prices of transport services also see indirect increases. Many products, including bottled gas, packaging materials, and chemicals, use crude oil as an input. Moreover, a rise in oil prices influences inflation indirectly through channels such as backward-indexation behavior that might be brought on by rising inflation, worsening inflation expectations, and exchange rate pressure driven by a deteriorating current account balance.

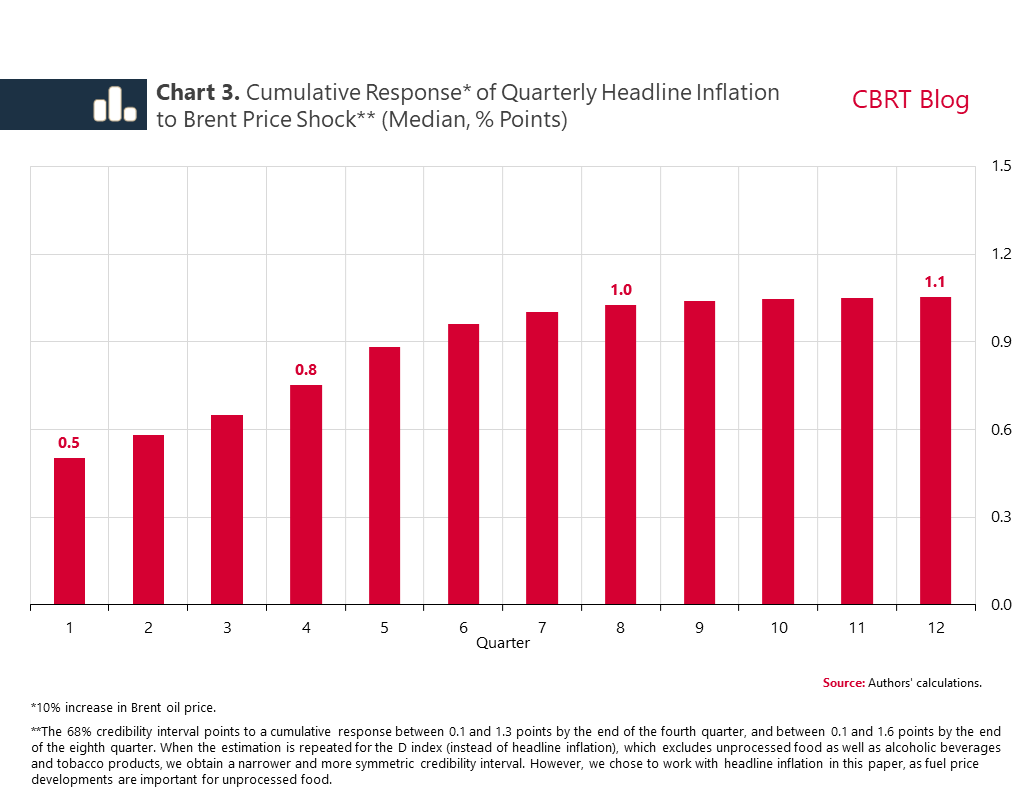

We estimate a Bayesian Vector Autoregression (VAR) model to gauge the impact of crude oil prices on headline inflation.[2] Our findings suggest that a 10% increase in crude oil prices ultimately leads to a one-point increase in consumer inflation. With almost half of it emerging in the first quarter, the total effect amounts to approximately 0.8 points by the end of one year (Chart 3).

In the May Inflation Report, it was assumed that the Brent oil would be USD 62 in June 2025. Regarding the inflationary pressures that current developments in Brent oil prices will generate, a simple calculation enables us to interpret what the above-mentioned elasticities imply. Accordingly, we create a scenario of an average increase of USD 10 in the Brent oil price in July, which is approximately a 16% uptick. Under this scenario, our projection for annual inflation at the end of 2025 increases by 1.2 points with direct and indirect effects, and the total increase adds up to 1.6 points at the end of one year.

Crude oil prices have a direct effect on the current account balance through energy imports and exports. To quantify this effect, we assume that price elasticity in exports and imports is zero and the rise in oil prices directly affects foreign trade figures.[3],[4] In that case, we calculate that every USD 10 increase in oil prices leads to a rise of around USD 2.6 billion in the current account deficit in the next 12 months. In fact, it is predicted that an average price increase of USD 10 in crude oil will push the imports and exports of oil upwards by USD 5.1 billion and USD 2.2 billion, respectively. Consequently, a substantial portion of the rise in imports driven by the surge in crude oil prices is offset by exports. Moreover, when calculating the net impact on the current account deficit, we factor in the repercussions of these increases on the balance of payments-defined foreign trade adjustment items and net transportation revenues (a USD 0.3 billion surplus and the exact amount of decrease in the current account deficit). Assuming the same scenario, there is an upside risk of USD 1.2 billion to the current account deficit in 2025 over the last two quarters (Chart 4).

In sum, crude oil prices are highly volatile and can fluctuate significantly throughout the year. Recent developments have confirmed this. Developments that lead to sharp increases in crude oil prices may have adverse effects on key macroeconomic indicators, depending on how persistent they are.[5] Our calculations, which are based on the assumption of a USD 10 increase in the Brent oil barrel price, indicate that the impact on key macroeconomic variables will be manageable.

[1] The weight of fuel in the consumer basket has recently been declining, from 4.9% in 2022 to 3.3% in 2025. Moreover, the lump-sum tax on fuel products limits the pass-through of crude oil prices to domestic product prices.

[2] For further information about the method, see: Öğünç, F. (2019), “A Bayesian VAR Approach to Short Term Inflation Forecasting”. CBRT Working Paper (No.19/25). The sample covers the post-2011 period. Our model includes the global growth, Brent oil price, import unit value index, exchange rate basket, credit, output gap, and headline inflation variables. All variables, other than output gap and credit, are included in the model as quarterly log-differences. Additionally, minimum wage and a variable measuring the effects of administered prices and taxes, have been added to the model as exogeneous variables. We estimate the model with four lags. The global growth indicator denotes the export-weighted series. Credits have been adjusted for exchange rates and deflated; the series has been standardized, and its 13-week average has been taken. Output gap is the simple average of eight different indicators developed by the CBRT. Credit and output gap series are, by definition, stationary. For further insight into these two series, see Inflation Report 2025 – II, Charts 2.4.13 and 2.4.14.

[3] Price elasticity of crude oil import and export demand is limited. In other words, even if an upsurge is recorded in oil prices, the amount of imports and exports do not register a notable decline.

[4] Our estimations exclude the indirect effects of hikes in oil prices on the current account deficit through domestic and external demand.

[5] Given the interaction of oil price shocks with geopolitical developments, there may be greater pressure on exchange rates than was projected in this article. In such a case, the exchange rate shock should also be included in the analyses.